r&d tax credit calculation uk

Profit-making SME with 10000 RD spend. Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000.

50000 x 230 Expenditure Enhancement 115000 115000 Enhanced Expenditure Value x 145 RD Surrender Rate 16675 Will your business qualify.

. Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. 10000 x 130 enhancement rate 13000. Steps to calculate the RD tax credit via the traditional method 2 Total the QREs for the current tax year Determine aggregate QREs over a base period Divide the aggregate QREs by the.

Based on the information. The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA. Call today for your free review.

The rate of relief is 25. 70000 - 24167 45833 x 14. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend.

RD Tax Credit Calculator. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. The RD credit is calculated on the federal income tax return as usual and may be applied against payroll taxes starting the quarter after the credit is elected.

Average calculated RD claim is 56000. Insert an estimate of your employee costs subcontractor costs and any materials and software costs into the calculator Press the Maximum estimated benefit button at the bottom of the. Free RD Tax Calculator.

With a 100 success rate qualified and experienced staff and sector specialists at our disposal we make the process quick and hassle-free. If the company spent 100000 on RD projects in a year. 12 from 1 January 2018 to 31 March 2020 13 from 1.

Work out the costs that were directly attributable to RD. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Heres your RD Report.

Ad Our sector specialists can maximise your RD claim. The qualifying expenditure is 100000 thats already in accounts as expenditure. One of the hard issues to understand about RD Tax.

Use our simple calculator to see if you. Ad Our sector specialists can maximise your RD claim. Call today for your free review.

The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. This calculation example shows how RD tax credits can benefit a. 2903 2023 Proposed Changes to the UK RD Tax Regime.

Company X made profits of 400000 for the year calculate the RD tax credit saving. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. So many businesses engage.

Reduce any relevant subcontractor or external. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as follows. RD Tax Credit is 212500 1453081250 CT600 boxes 530875 Losses to carry forward are zero.

It was increased to. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss. If youre a loss-making business youll receive your RD tax credit in.

2403 UK 2022-2025 RD Budget. Calculate how much RD tax relief your business could claim back. How to calculate RDEC To calculate your expenditure you need to.

RD Tax Credit Calculation. The initial credit equaled 25 percent of a corporations research spending in excess of. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they.

Sample calculations for RD tax relief claims. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. 13000 x 19 corporation tax rate 2470.

Get to know how much RD spend your company can claim back.

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

Has Hmrc Got Your P800 Calculation Right Tax Rebate Services

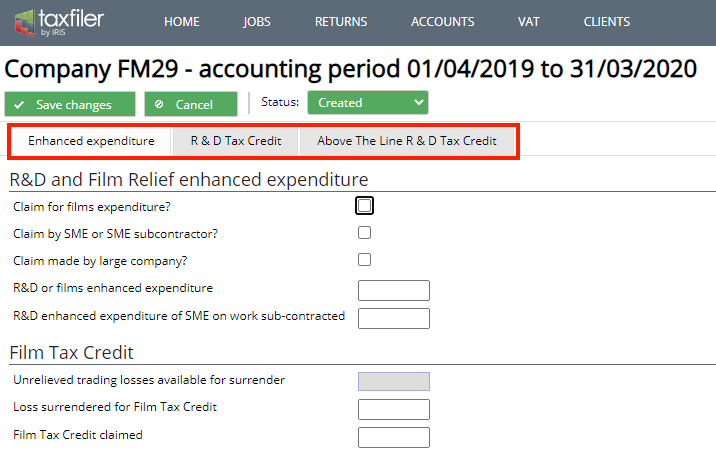

Research And Development Or Film Relief And Tax Credits Support Taxfiler

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Examples R D Tax Solutions

9 958 Income Tax Illustrations Clip Art Istock

Calculating The R D Tax Credit Randd Tax

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Calculation Examples Mpa

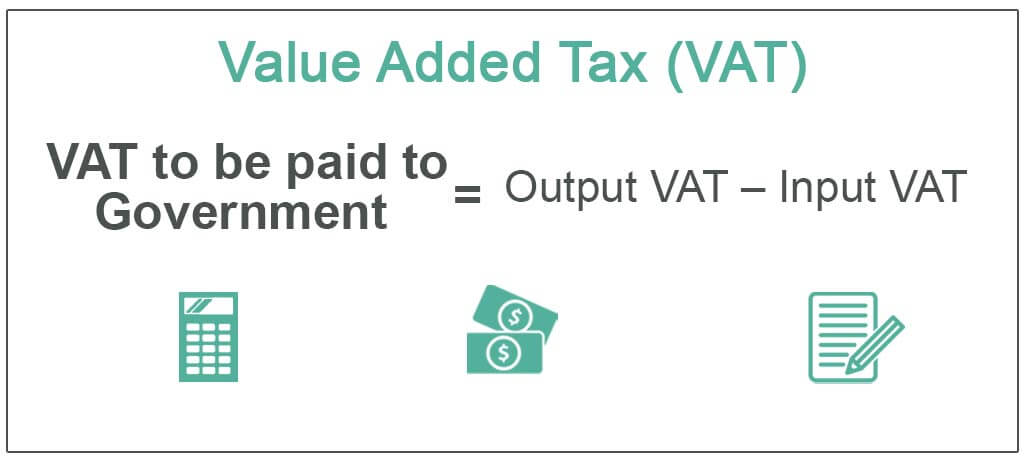

Value Added Tax Definition Formula Vat Calculation With Examples

R D Tax Credit Rates For Rdec Scheme Forrestbrown

9 958 Income Tax Illustrations Clip Art Istock

China Annual One Off Bonus What Is The Income Tax Policy Change

Salary Or Dividends Tax Calculations Money Donut

Rdec 7 Steps R D Tax Solutions

R D Tax Credit Rates For Sme Scheme Forrestbrown

Invoice Or Bill Discounting Or Purchasing Bills Trade Finance Accounting And Finance Financial Strategies

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)